Contents

Introduction

AI-Driven Trading Bots in 2025 are redefining digital-asset trading. By combining real-time analytics and automation, these revolutionary bots deliver speed, precision, and profitability to crypto investors.

Watch: The Future of AI-Powered Trading Bots in 2025

Artificial Intelligence is reshaping the very foundation of cryptocurrency markets — transforming trading from emotional guesswork into data-driven precision. In this short video, discover how next-generation AI trading bots are analyzing millions of data points, executing trades in milliseconds, and reshaping the global financial landscape.

🎙️ Video Narration Script (as spoken in the AI Brain Studio video):

“Welcome to the future of crypto trading — where intelligence meets automation. In 2025, revolutionary AI-driven trading bots are redefining how we invest and profit in digital assets. They process live market data, detect hidden patterns, and predict price moves with precision human traders can only dream of. Whether it’s Bitcoin, Ethereum, or emerging DeFi projects — these intelligent bots operate 24/7, learning and evolving with every trade. The result? Smarter strategies, consistent gains, and an entirely new era of AI-powered trading.”

📊 Continue Reading: Learn how these cutting-edge AI bots are transforming crypto markets, the technologies driving them, and how you can integrate similar trading automation into your portfolio today.

AI-Driven Trading Bots in 2025 are revolutionizing the way crypto markets operate. These intelligent systems use advanced machine-learning models to analyze massive amounts of data, predict price movements, and execute orders with lightning speed. By removing human emotion and error from trading decisions, these bots are transforming crypto investing into a smarter and more profitable experience for traders worldwide.

AI trading bots 2025 are reshaping the future of cryptocurrency markets. In 2025, investors no longer depend solely on manual strategies — AI-driven algorithms are executing trades, managing risk, and spotting profit opportunities within milliseconds. This post explores how AI trading bots 2025 work, why they matter, and how you can use them to maximize your crypto performance.

The era of purely manual crypto trading is evolving. Today, more and more traders are turning to AI-powered tools to handle the rapid pace, huge data-volumes, and 24/7 nature of the crypto market. In 2025, the game-changer is no longer just “which coin to pick” but “which algorithm” is picking for you. In this article we’ll explore what AI trading bots are, why they matter now more than ever, how you can choose one, and what risks to watch out for.

🎧 Listen & Watch: Green Circle Business – AI Brain Studios Presentation

Enjoy this AI-generated audio and video presentation by DeepBrain AI Studios, exploring how the Green Circle Business concept blends sustainability, automation, and intelligence for future-ready growth.

💡 Discover how AI and sustainability merge to shape the Green Circle Business model — an innovation framework powered by data, automation, and environmental vision.

#GreenCircleBusiness #DeepBrainAI #AIStudios #AIInnovation #BusinessTrends2025 #SustainableGrowth #AIVideo #AIAudio #DigitalTransformation

What are AI Trading Bots?

In simple terms, an AI trading bot is software that automates your buy/sell decisions by analysing market data, technical indicators, sentiment, news feeds and executing trades — sometimes across multiple exchanges. According to reviews, these systems “use machine learning to automate and optimise trades, analysing market trends, news and technical data.” Koinly+1 They’re no longer simple rule-based bots (e.g., “if RSI <30 then buy”) but adapt-and-learn systems.

Why They Matter in 2025

Why AI Trading Bots 2025 Matter for Modern Investors

- 24/7 Market / No Breaks – Crypto never sleeps. Bots operate all day, all night.

- Data Overload – With thousands of coins, countless pairs, social signals and news, humans alone can’t keep track. AI helps filter.

- Speed & Execution – Bots can execute faster than manual traders, reducing delays and emotion-driven errors.

- Advanced Strategies – Grid trading bots, DCA (dollar cost averaging) bots, arbitrage bots, and AI-driven bots are increasingly available. For example: “AI-powered grid trading bots offer a compelling way to harness automation and data-driven insights.” NASSCOM Community 5. Lower Entry Barrier – As platforms evolve, even beginners can plug into bot-services rather than coding their own.

Top Features to Look For

Top AI Trading Bots 2025 Features to Look For

When choosing an AI trading bot (or considering one), make sure it has these core features:

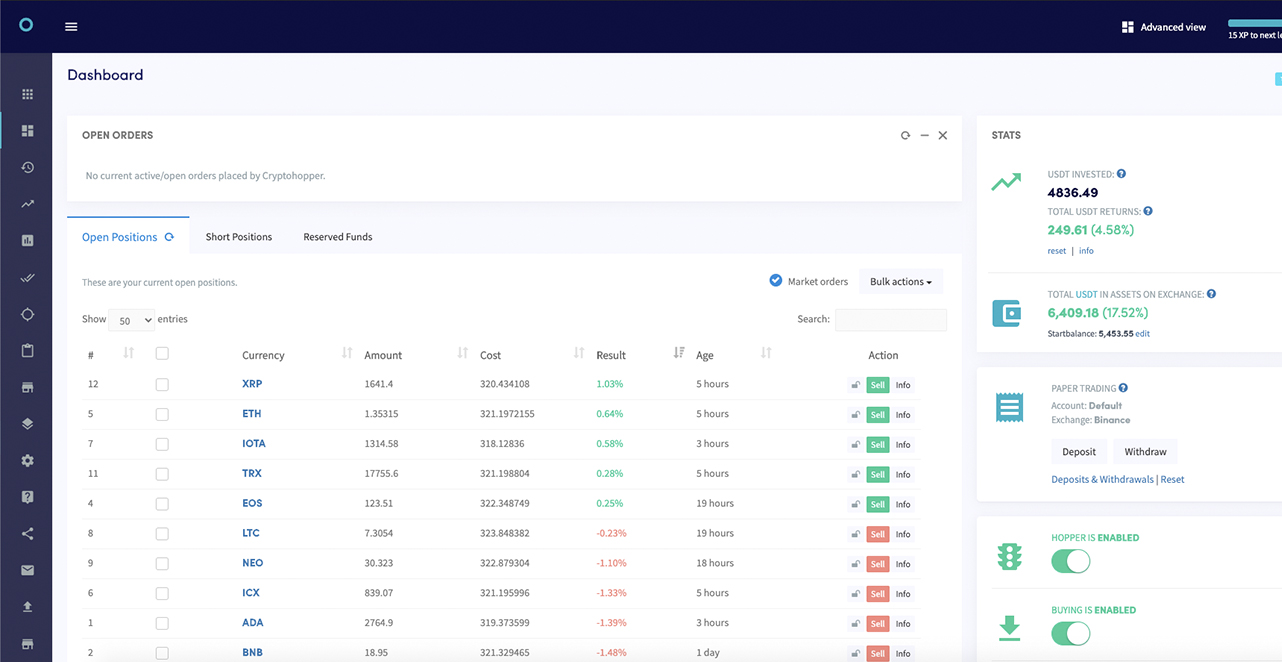

- Multi-exchange support – The more places it connects, the wider your opportunity. (Platforms like 3Commas, Cryptohopper are often cited.) Coin Bureau+1

- Machine-learning / adaptive logic – Not just fixed rules, but bots that learn and adjust.

- Back-testing & simulation – Test strategy before going live.

- Risk management tools – Stop-loss, take-profit, position size rules, etc.

- Transparency & track record – Many bots claim huge returns — but some are hype. For example: “the vast majority of platforms offering insane returns with AI trading bots are scams and should not be trusted.” Koinly+1

Example Use-Case: Grid Bot + AI

Imagine you deploy a grid-trading bot that sets buy/sell orders in a range around a mid-price. On top of that an AI layer examines news, sentiment, and volatility and dynamically shifts the grid’s range or size. This hybrid approach is increasingly cited as a frontier in 2025. NASSCOM Community

What It Means for Crypto Markets

- Professionalisation of retail trading – As bots level the playing field, individual traders can access more advanced tools once reserved for institutions.

- Higher frequency & shorter time-frames – Bots tend to trade faster, meaning volatility and liquidity become even more critical.

- Shift in competitive advantage – It’s no longer just choosing the right coin; it’s deploying the right system.

- Risk of crowding – If many bots use similar strategies, market saturation may reduce edge.

Risks & Considerations

- Over-reliance on automation – Bots are not magical; garbage in => garbage out. They depend on data quality and parameter settings.

- Technical risk – API failures, exchange downtime, bug in bot logic can lead to losses.

- Hidden costs & fees – Subscription costs, slippage, spreads matter.

- Regulatory & tax treatment – Even if bots do the trading, you still need to manage tax and compliance.

- Scams & hype – Many bot-services promise unrealistic returns. As one authority puts it, “the vast majority … are scams.” Koinly+1

How You Can Use One (Step-By-Step)

- Choose a reputable bot-service with good reviews and transparency.

- Link your exchange via API with tight permission settings (e.g., disable withdrawal rights).

- Back-test the strategy within the bot, using historical data.

- Start small (risk capital you can afford) and monitor results.

- Use risk-management settings (stop-loss, max drawdown, position size).

- Regularly review performance, adapt strategy or turn off if under-performing.

- Keep a log of your trades for tax / accounting.

The Rise of AI-Driven Trading Bots in 2025

AI-Driven Trading Bots in 2025 are revolutionizing the crypto world by bringing automation, precision, and speed to every trade. These bots rely on advanced algorithms and machine-learning models that react instantly to market changes, providing consistent performance even during volatility.

Experts predict that AI-Driven Trading Bots in 2025 will manage over 60% of crypto volume, highlighting their growing dominance in automated trading and algorithmic decision making.

Why AI-Driven Trading Bots in 2025 Dominate Crypto Strategies

The efficiency of AI bots allows traders to minimize human error and emotion-driven decisions. They analyze price trends, news sentiment, and blockchain data simultaneously, identifying opportunities that manual traders might miss.

Key Advantages for Retail and Institutional Traders

- 24/7 trading with real-time execution

- Emotion-free and data-driven decisions

- Faster response to price fluctuations

- Consistent long-term profitability

By combining artificial intelligence with predictive analytics, these systems create an edge that helps both novice and professional investors outperform traditional strategies.

Transforming the Future of Crypto Markets

As AI adoption grows, exchanges and hedge funds are investing heavily in intelligent automation. The next evolution of trading will rely on adaptive AI frameworks capable of learning from market patterns and improving autonomously.

Traders using AI-Driven Trading Bots in 2025 gain an emotion-free edge, allowing them to execute data-driven decisions and outperform traditional investors in both bull and bear markets.

Final Thoughts

AI-Driven Trading Bots in 2025 represent the future of intelligent finance. They merge speed, accuracy, and innovation to reshape how crypto investments are made. To explore more AI-based trading insights and tools, visit BitVoltAI.com.

Real-World Impact of AI-Driven Trading Bots in 2025

Experts predict that AI-Driven Trading Bots in 2025 will manage over 60% of global crypto trading volume, underscoring their rapid adoption by both retail and institutional investors.

Traders using AI-Driven Trading Bots in 2025 gain an emotion-free edge, allowing them to execute data-driven decisions, reduce risk, and capture opportunities that human traders often miss. These systems run 24/7 and learn continuously, adapting to market trends with remarkable precision.

To explore detailed insights, performance case studies, and AI-powered trading tools, visit BitVoltAI.com.

Affiliate Note

If you’re looking for a fast-track, there are platforms that offer affiliate/referral links for bot-services. For instance, the links below may help:

- ClickBank Affiliate Link: https://09381nqhr169foj3yklbglbped.hop.clickbank.net

- Digistore24 Affiliate Link: https://tinyurl.com/mrpuav7w

(Ensure you comply with local regulations and disclose properly when using these links.)

Visuals & Chart Block

6

Live crypto-price chart embed (paste into your site where your theme supports it — example using TradingView widget):

🔗 Next Read: [Meme Coins Go Viral Again — Why AI Meme Tokens Are the New Crypto Trend 2025](https://bitvoltai.com/ai-meme-tokens-crypto-trend-2025/)🔗 Next Read: Top 5 AI Tools for Crypto Trading Success

🔗 Related: Will AI Replace Crypto Analysts by 2030?

Conclusion

AI-driven trading bots are reshaping the crypto landscape in 2025. They provide powerful tools for automation, speed, and data-driven decision making. But they’re not a silver bullet — good strategy, risk management, transparency and constant review remain essential. If used wisely, they can be a major asset in your trading toolbox.

Legal Disclaimer

The information provided in this article titled “Revolutionary AI-Driven Trading Bots in 2025: Transforming Crypto Markets Forever” on BitVoltAI.com is for educational and informational purposes only. Nothing contained herein constitutes or should be construed as financial, investment, legal, or tax advice.

BitVoltAI.com and its authors are not registered financial advisors, brokers, or investment consultants. All opinions expressed are based on independent research, publicly available data, and general informational insights.

Cryptocurrency trading and AI-driven financial tools involve substantial risk. You may lose part or all of your invested capital. Past performance of any AI or automated trading system does not guarantee future results. Always perform your own due diligence and consult a qualified financial professional before making investment decisions.

The article may contain references and external links to third-party tools, software, or exchanges. These are provided for your convenience only. BitVoltAI.com does not control, endorse, or guarantee the accuracy, legality, or reliability of any external websites, services, or information mentioned herein.

Affiliate Disclosure: Some links on this page may be affiliate links. This means that if you click and make a purchase through those links, BitVoltAI.com may earn a commission at no additional cost to you. We are participants in the ClickBank and Digistore24 affiliate programs, which help support our research, content creation, and maintenance of this website.

However, the inclusion of any affiliate products does not influence our editorial content or analysis. We recommend products or services only when we genuinely believe they offer value to our readers.

By accessing and reading this article, you acknowledge that you understand and agree to this disclaimer in full. BitVoltAI.com, its authors, and affiliates expressly disclaim any liability for any loss or damage, direct or indirect, arising from your use or reliance on the information provided here.

Leave a Reply